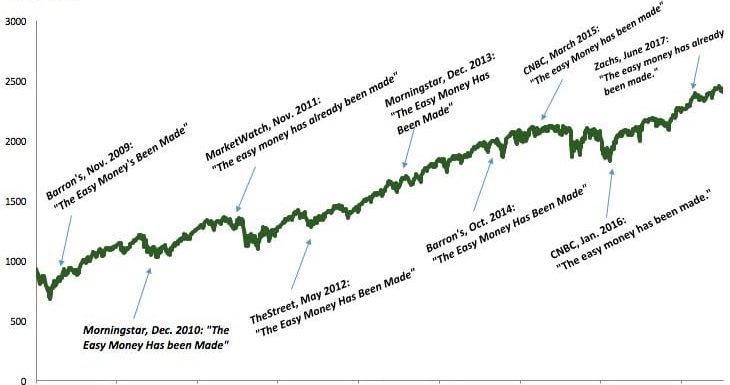

“The easy money has been made.” If you follow CNBC, Barron’s, or other major financial news outlets, you may have heard this term often. This phrase is used as a way to claim that positive stock market returns in the future will be harder to come by and to invest with caution, as the road ahead is bumpy. Above is a chart showing the returns of the S&P 500 over the past 10 years, along with the times these outlets suggested, “The easy money has been made.” The question is, should you listen?

I know what my answer is!

Predictions are hard, not just for the stock market. Philip Tetlock is a political science writer and professor who spent years studying the experts’ forecasts and determining their accuracy. In his 2003 book titled “Expert Political Judgement. How Good Is It? How Can We Know?” he recounts his 18-year study working with 284 renowned experts in political and economic fields. He studied over 28,000 forecasts made by these experts and found out that after 18 years, they were no more accurate at predicting what would happen than random chance. Another interesting finding was that the more famous and well known a forecaster was, the more inaccurate their predictions were compared to the lesser-known analysts.

We have all seen this in other fields as well. NCAA basketball brings us March Madness, where an individual will watch every game of the year, study their brackets like it is SAT prep, only to lose to the person who picked the winning teams simply by the school colors or their favorite mascot.

Even better is during the World Cup in soccer, where an actual octopus at an aquarium in Germany named Paul routinely predicts winners more accurately than analysts. Before each game, Paul the octopus would be presented with two different boxes of food, identical except each box was decorated with the different flags for the two teams playing. The box Paul swam to was deemed his choice to win. And no surprises, Paul beat most of the analysts who spent their lives playing and studying the game. In the 2010 world cup, Paul even predicted the winner with 85.7% accuracy.

Timing the stock market

So if pundits are wrong so often, why do we listen still? It could be that we all crave the certainty it brings when we hear an “expert” make a statement so confidently. Or perhaps because we feel that since they are on TV and paid to give an opinion, it must be worth listening to. The truth is, when it comes to your life, you are the expert. You know what is important to you, what matters to you, and what your values are. Not a TV pundit. You have a financial plan; you know your goals and the next steps you can take towards them. If 2020 has proven anything, it has demonstrated that it is hard to predict what the next month will bring, let alone 10 years down the road. We can, however, be prepared with a planning process to provide a framework to make great choices, no matter what they are.

The source for the chart is a twitter account: @morganhousel.