The stage is set…it is Trump/Pence vs Biden/Harris. And just in case 2020 has not been eventful enough, let’s add Kanye West to the mix.

So much has happened politically and economically in 2020, that it only makes sense the stock market has gone on a wild ride. Will the upcoming election be a source of uncertainty and caution for investors, or will the market continue on this incredible rally? Is one of the candidates better for the markets?

Our clients know what our wisdom-filled answer is: nobody knows!

Politics is a personal and emotional subject, and let me just get it out of the way I am certainly not writing anything about politics with this piece. However, being a financial planning firm, we get a lot of questions about how certain presidents and political changes could potentially affect one’s finances. It doesn’t matter which party one supports, people naturally express concern over what direction the opposing president will take the country, economy, the stock market and their savings with it.

As always at Wealth Analytics, we don’t want to listen to people on TV claiming to have a crystal ball or making bold predictions to get website traffic. We want to rely on data and research.

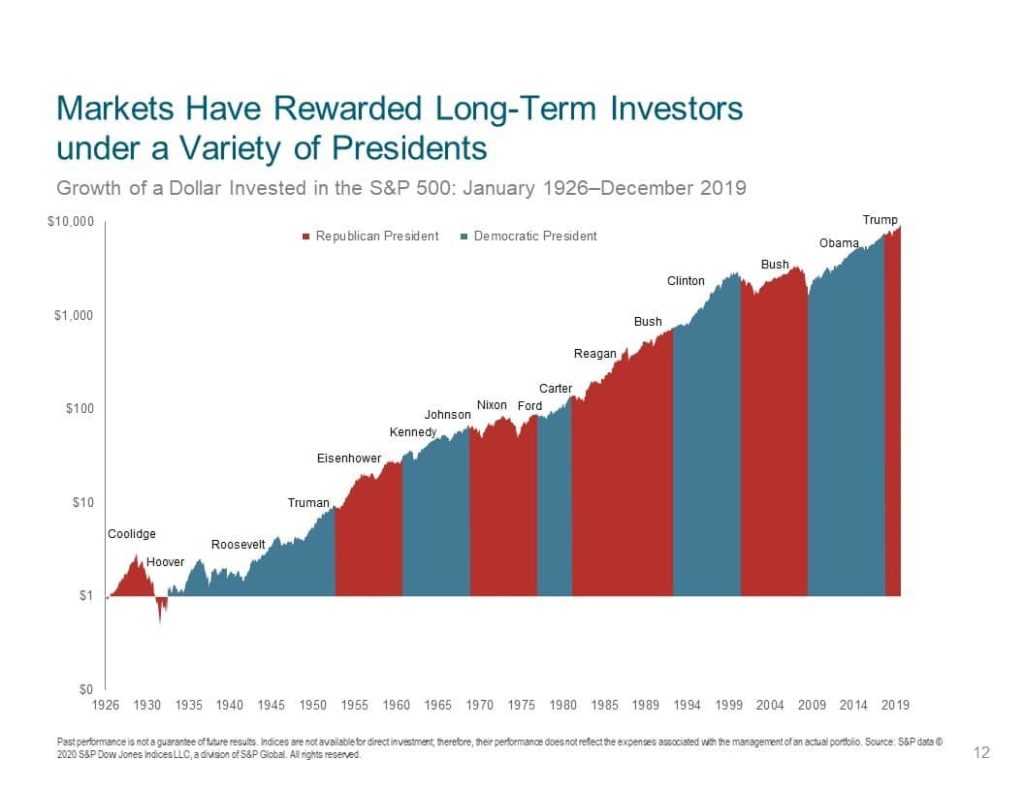

So what does the data show? Does the president affect the stock market or are certain political parties better for investors? Looking through all the data of market returns under different presidents, along with different levels of party control in Senate and Congress, no evidence or pattern emerges showing stocks react a certain way. No matter who the president is, or what party is in control, markets have tended to go up about the same amount.

This is a Sample Heading

Simply put, that is what markets do. Over time they have tended to go up more often than they go down. This is because one of the singular truths of investing is that the longer you stay invested, the higher the odds of making money. Looking at the data from 1950 on for the S&P 500, if you invest for one month, it’s a coin flip if you make money. If you stay invested for a year the odds of making money go to above 70%. Stay invested for 10 years and the odds jump to 94%. And for those patient investors, those staying invested for over 20 years, so far that number has been a nice round 100%.

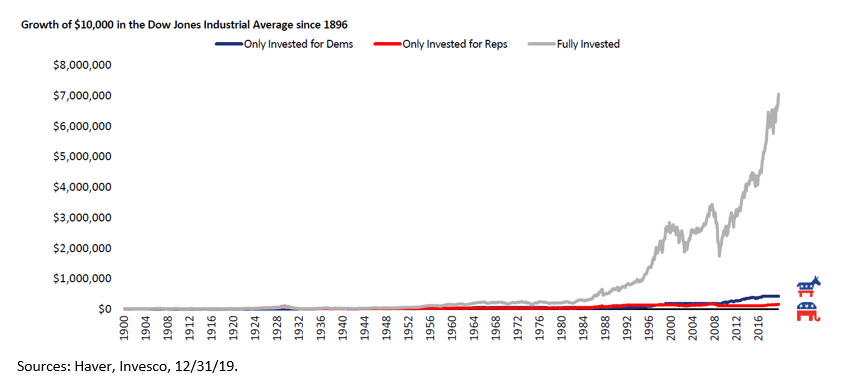

Just like timing the market is impossible, making investment decisions based on presidents or shifts in political control is a dangerous game. Markets have a cruel way of punishing those who try to outsmart it. The below graph is a favorite of mine showcasing this topic. It presents three lines showing the growth of money over time invested in the Dow Jones Index since 1896. The gray line represents the growth of money invested in the market and not touched, remaining fully invested no matter the administration. The red line represents the growth when the money was only invested during Republican administrations, and the blue line shows the growth when invested only during Democratic administrations. I know which line I would like to be on.

The goal of investing is to capture the long term returns of capital markets, regardless of who is in power in the White House. Companies will continually try to innovate, and when some struggle, others shine as we have seen in the past few months.

Of course, this time could be different…there is no doubt about that. Past performance does not dictate future results. So individual investors need to decide on what risks they choose to take. Historically, the market has rewarded investors who have chosen to accept the long-term risks in markets, no matter who the president has been.

Will they continue to? What do you think? We want to know your thoughts. Are you nervous about the markets during an election?

As always, we will be here to help clients plan for the future and advise them the best we can. As we did with the SECURE Act in 2019, the CARES Act of 2020, and our ongoing discussions of Roth conversions to take advantage of current tax rates. We will be watching for changes to markets, tax law, and any future policy changes that could provide obstacles or opportunities for our clients.